likelihood of capital gains tax increase in 2021

For example the Tax Foundation originally estimated that in 2021 those in the 20 th to 40 th percentiles would see a 15 percent increase in after-tax incomes on a conventional basis while the bottom 20 percent would receive about a 1 percent boost in after-tax incomes. When the NIIT is added in this rate jumps to 434.

The chances of big tax.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. Looking at this proposed change in the context of past changes shows that both Democratic and Republican presidents have signed legislation with retroactive tax provisions.

Additionally a section 1250 gain the portion of a. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of your business.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. Concerns that the tax law could changeand specifically that capital gains taxes will increaseis pushing investors to sell properties before the clock strikes 2022.

As a reminder the proposal calls for taxing long-term capital gains at ordinary income rates for high-income individuals and trusts 408 being the highest capital gains rate with a 37 income tax rate and the 38 net investment income tax. If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as the.

A tax on unrealized capital gains. This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37.

The bank said razor-thin majorities in the House and Senate would make a big increase difficult. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. Thats a key takeaway from a survey of 15 current and former White House and congressional aides specializing in tax policy completed by Bloomberg this month.

While it is unknown what the final legislation may contain the elimination of a rate increase on capital gains in the draft legislation is encouraging. President Bidens proposal to increase the capital gains tax has generated tremendous discussion. A retroactive change may be hard to get through congress because capital gains rates have been.

How do we tax capital gains now. Would bring in 290 billion between 2021 and 2030. However taxing gains at death creates challenges for investors that eliminating basis step-up and moving to.

Since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. Short-term capital gains come from assets held for under a year. The current tax preference for capital gains costs upwards of 15 billion annually.

Top Combined Capital Gains Tax Rates Would Average 48 Percent Under Bidens Tax Plan Tax Foundation Apr. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. Based on filing status and taxable income long-term capital gains for. Note however that proposal also calls for an increase in ordinary income rates to a top rate of 396.

Executive Summary Biden Proposal Raises Top Capital Gains Rate To 396 Ordinary Income Tax Rate Once-In-A-Lifetime Business Sales Could Trigger 396 Capital Gains Tax Biden Budget Changes To Capital Gains Rules Likely Not Effective Before 2022 Minimizing Business Owner Taxation For Near-Term Targeted Liquidity Events Business Owners Must Act. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. The rates do not stop there.

What S In Biden S Capital Gains Tax Plan Smartasset

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

How To Save Capital Gain Tax On Sale Of Residential Property

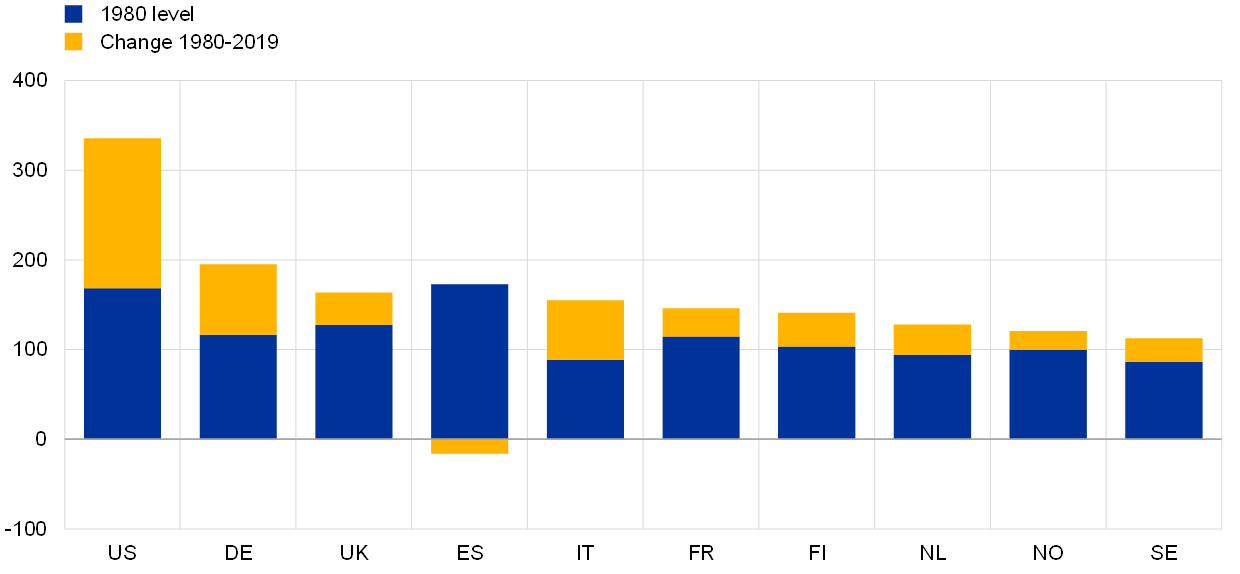

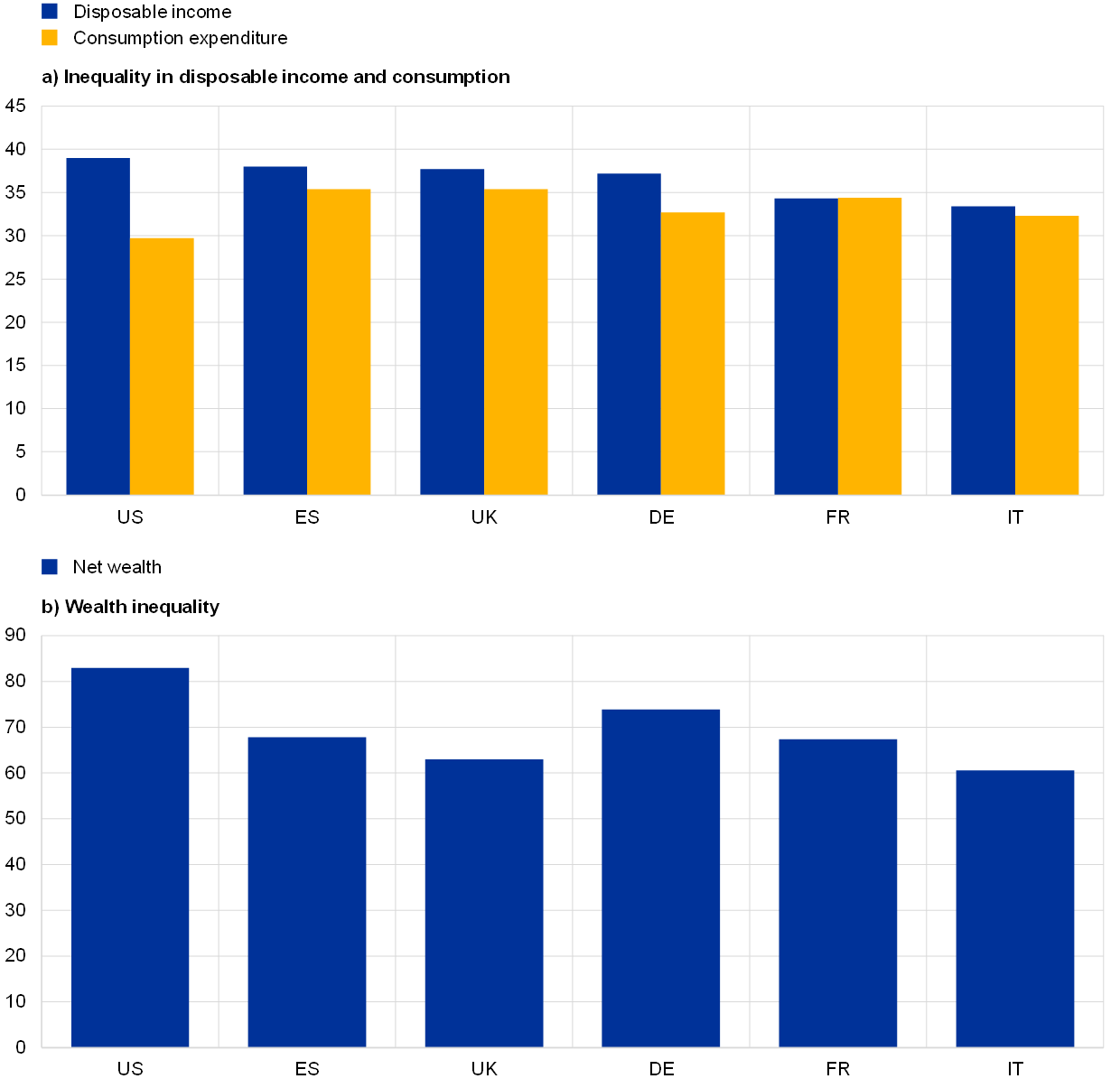

Monetary Policy And Inequality

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Difference Between Income Tax And Capital Gains Tax Difference Between

Monetary Policy And Inequality

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

There S A Growing Interest In Wealth Taxes On The Super Rich

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Dividend Tax Rates In 2021 And 2022 The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)